|

A wise man advises me that I should elaborate on the epistemological issues raised toward the end of my last post “Is Asset Pricing Scientific?” (April 3, 2021). This post is my response.

The Fama-French 3-factor model is arguably the most important work in asset pricing in the past 25 years. It is thus not surprising that the new way of thinking epitomized in the q-factor model has been met with high hurdles, one after another. To make sense of my professional predicament in the past decade, I have recently started to explore philosophy of science. Kuhn (1977, p. 357) describes five virtues that scientists must consider when deciding between an established theory and an upstart competitor. In particular, how should one choose between the Fama-French 3-, 4-, 5-, and 6-factor models on one side and the q-factor model and its extension, the q5 model, on the other? First, Kuhn says that a theory should be accurate: “within its domain, that is, consequences deducible from a theory should be in demonstrated agreement with the results of existing experiments and observations.” The head-to-head factor spanning tests reported in my last post clearly show that the q-factor model is more accurate than the 6-factor model. In fact, we have been reporting such evidence since 2014 (first with the 5- then with the 6-factor model). Second, Kuhn says that a theory should be consistent, “not only internally or with itself, but also with other currently accepted theories applicable to related aspects of nature.” The q-factor model is internally consistent. It is built from, and consistent with, the net present value rule in corporate finance. The rule says that, uncontroversially, investment policy is the first-order determinant of firm value. Riding on the first principle of firms, the q-factor model is also consistent with, and complementary to, the consumption CAPM. The investment versus consumption CAPM debate is only about the scope of applications, not a matter of theory replacement (like the q- versus 6-factor model). In my view, the 6-factor model falls short of the consistency criterion, both internal and external. Internally, it is not clear how UMD arises from valuation model. In addition, expected investment and expected return correlate positively in the model, not negatively (Hou et al. 2019). Externally, the theoretical linkage between common factors and ICAPM-APT state variables is tenuous (Zhang 2017). Third, a theory should have broad scope in that “a theory’s consequences should extend far beyond the particular observations, laws, or sub-theories it was initially designed to explain.” The q-factor model is broad. In particular, Hou, Xue, and Zhang (2015) write “the consumption model and the investment model of asset pricing are equivalent in general equilibrium, delivering identical expected returns. While the consumption model says that consumption risks are sufficient for accounting for expected returns, the investment model says that characteristics are sufficient. We take the latter prediction seriously and confront the q-factor model with a wide array of anomaly variables that are not directly related to investment and profitability (p. 658, footnote 8).” In other words, just like only beta matters in the CAPM, only investment and profitability matter for the cross-sectional expected-return dispersion in the q-factor model. In Popperian (1962) terms, this conjecture is very bold and highly refutable. Yet, the evidence largely confirms our conjecture. Popper would have liked the q-factor model. Fourth, a theory should be simple, “bring order to phenomena that in its absence would be individually isolated and, as a set, confused.” I started out with complicated modeling in Zhang (2005), simplified substantially to Euler equation tests in Liu, Whited, and Zhang (2009), and finally arrived at the investment and profitability factors in Hou, Xue, and Zhang (2015). It is simple to be complicated and complicated to be simple. Each layer of simplification comes with, I think, a deeper layer of understanding of the inner workings of capital markets. In the end, only the net present value rule is left standing. In philosophy of science, the no-miracles argument for scientific realism says that the predictive success of science would be a miracle if predictively successful scientific theories were not at least approximately true (Putnam 1975). In asset pricing, this argument implies that the strong explanatory power of the simple q-factor model would be a miracle if its underlying theory (the investment CAPM) was not at least approximately true in capital markets. Fifth, a theory should be fruitful of new research findings: “it should, that is, disclose new phenomena or previously unnoted relationships among those already known.” Lakatos (1970) defines a scientific research program as “progressive” as long as its theoretical growth keeps predicting novel facts with some success. A program is “degenerate” if its theoretical growth lags behind its empirical growth, that is, it gives only ex post, ad hoc explanations of facts anticipated by, and discovered in another program. If a research program progressively explains more than a rival, then it supersedes the rival. And the rival program can be eliminated. In Lakatosian terms, the q-factor model is one exemplar from a scientific research program that I call the supply theory of value. The “hard core” of this program is to price assets based on the first principles of their suppliers. To make contact with data in the real world, this hard core is supplemented with a variety of “protective belt.” The belt includes the measurement of investment, profitability, and expected growth as well as factor construction; specifications of marginal product of capital and adjustment costs as well as structural estimation via GMM; and specifications of the pricing kernel and productivity as well as quantitative investigation. I feel that this research program is “progressive” in that it has successfully addressed a wide range of important issues, including factor models, scientific explanations of asset pricing anomalies, linking factor premiums to fundamentals via structural estimation, and the equity premium puzzle, etc. I will leave it to the reader to decide where the Fama-French program of the 3-, 4-, 5-, and 6-factor models resides in the Lakatosian degenerate-progressive spectrum. Where I stand is an open secret. In short, evaluated with Kuhn’s five virtues (accuracy, consistency, scope, simplicity, and fruitfulness), I feel that the q-factor model is the rightful heir of the 3-factor model. The q-factor model inherits everything cool about the 3-factor model, especially its empirical methods, but fills its glaring lack of theoretical foundation. American Finance Association Code of Professional Conduct and Ethics (2016, 3 (a)) says: “Financial economists should work to provide an environment that encourages the free expression and exchange of scientific ideas. They should promote equal opportunity and treatment for all their colleagues, regardless of age, gender, race, ethnicity, national origin, religion, sexual orientation, disability, health condition, marital status, parental status, genetic information, or any other reason not related to scientific merit. More senior members of the profession have a special responsibility to facilitate the research, educational, and professional development of students and subordinates. This includes providing safe, supportive work environments, fair compensation and appropriate acknowledgement of their contribution to any research results (p. 1-2, my emphasis).” Alas, “ought” does not mean “is.” If “is” is already achieved, there is no need to set up “ought” to begin with. Whether a theory change from the 3-factor model to the q-factor model occurs, and if yes, how long it will take, are left for future historians, who, presumably, will try to reconstruct how academic finance really works. I no longer worry about such things. I enjoy my work. And that’s all that matters to me. References Hou, Kewei, Chen Xue, and Lu Zhang, 2015, Digesting anomalies: An investment approach, Review of Financial Studies 28 (3), 650-705. Hou, Kewei, Haitao Mo, Chen Xue, and Lu Zhang, 2019, Which factors? Review of Finance 23 (1), 1-35. Kuhn, Thomas S., 1977, Objectivity, value judgment, and theory choice, in T. S. Kuhn: The Essential Tension, University of Chicago Press. Lakatos, Imre, 1970, Falsification and the methodology of scientific research programmes, in I. Lakatos and A. Musgrave: Criticism and the Growth of Knowledge, Cambridge University Press. Liu, Laura Xiaolei, Toni M. Whited, and Lu Zhang, 2009, Investment-based expected stock returns, Journal of Political Economy 117 (6), 1105-1139. Popper, Karl R., 1962, Conjectures and Refutations: The Growth of Scientific Knowledge, Basic Books. Putnam, Hilary, 1975, What is mathematical truth? In H. Putnam: Mathematics, Matter and Method, Collected Papers Vol. 2. Cambridge University Press. Zhang, Lu, 2005, The value premium, Journal of Finance 60 (1), 67-103. Zhang, Lu, 2017, The investment CAPM, European Financial Management, 23 (4), 545-603.

3 Comments

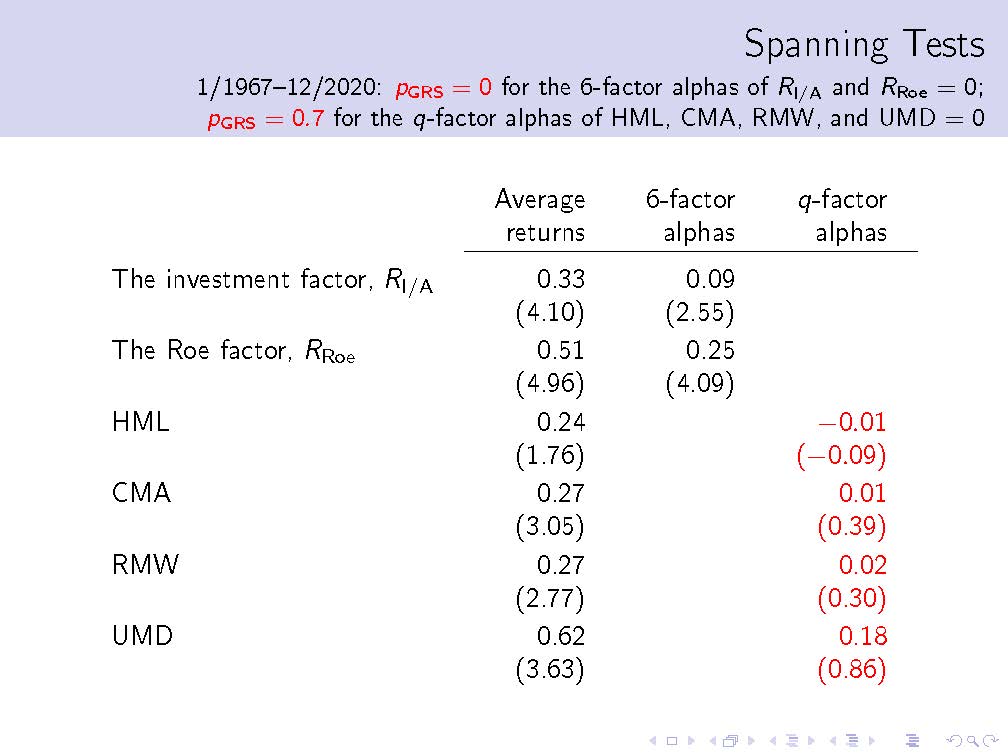

We have just released the latest q-factors data library that has been updated through December 2020. The table below shows that the Hou-Xue-Zhang (2015) q-factor model continues to fully subsume the Fama-French (2018) 6-factor model in the extended sample from January 1967 to December 2020. The 6-factor model cannot explain the q-factors. The investment premium is 0.33% per month (t = 4.1), with a 6-factor alpha of 0.09% (t = 2.55). The return on equity (Roe) premium is 0.51% (t = 4.96), with a 6-factor alpha of 0.25% (t = 4.09). The Gibbons-Ross-Shanken (1989, GRS) test strongly rejects the 6-factor model with the null hypothesis that the 6-factor alphas of the investment and Roe premiums are jointly zero (p = 0.00). More important, the Hou-Xue-Zhang q-factor model fully subsumes the Fama-French factors. The HML, CMA, and RMW premiums are on average 0.24%, 0.27%, and 0.27% per month (t = 1.76, 3.05, and 2.77), but their q-factor alphas are virtually zero, -0.01%, 0.01%, and 0.02% (t = -0.09, 0.39, and 0.3), respectively. UMD is on average 0.62% (t = 3.63), but its q-factor alpha is only 0.18% (t = 0.86). The GRS test fails to reject the q-factor model with the null that the q-factor alphas of HML, CMA, RMW, and UMD are jointly zero (p = 0.7). So, is asset pricing scientific? Popper's (1959) demarcation between science and non-science hinges on falsifiability. Lakatos (1970) says that a scientific research program should be "progressive" in that it needs to explain empirical puzzles with few ad hoc fixes. Despite his early "mob psychology" regarding theory choice in Structure (1962), Kuhn (1977) later characterizes a good theory in terms of its accuracy, consistency, scope, simplicity, and fruitfulness. Finally, Feyerabend (1975) argues that science is an anarchic enterprise with no particular epistemic order. While conscientious about external forces at work, I am determined to show Feyerabend is wrong about asset pricing. References Feyerabend, Paul, 1975, Against Method, New Left Books. Kuhn, Thomas S., 1962, The Structure of Scientific Revolutions, University of Chicago Press. Kuhn, Thomas S., 1977, Objectivity, value judgment, and theory choice, in T. S. Kuhn, The Essential Tension, University of Chicago Press. Lakatos, Imre, 1970, Falsification and the methodology of scientific research programmes, in Criticism and the Growth of Knowledge, I. Lakatos and A. Musgrave (eds.), Cambridge University Press. Popper, Karl, 1959, The Logic of Scientific Discovery, Hutchinson & Co. |

Lu Zhang

An aspiring process metaphysician Archives

September 2025

Categories |

RSS Feed

RSS Feed