|

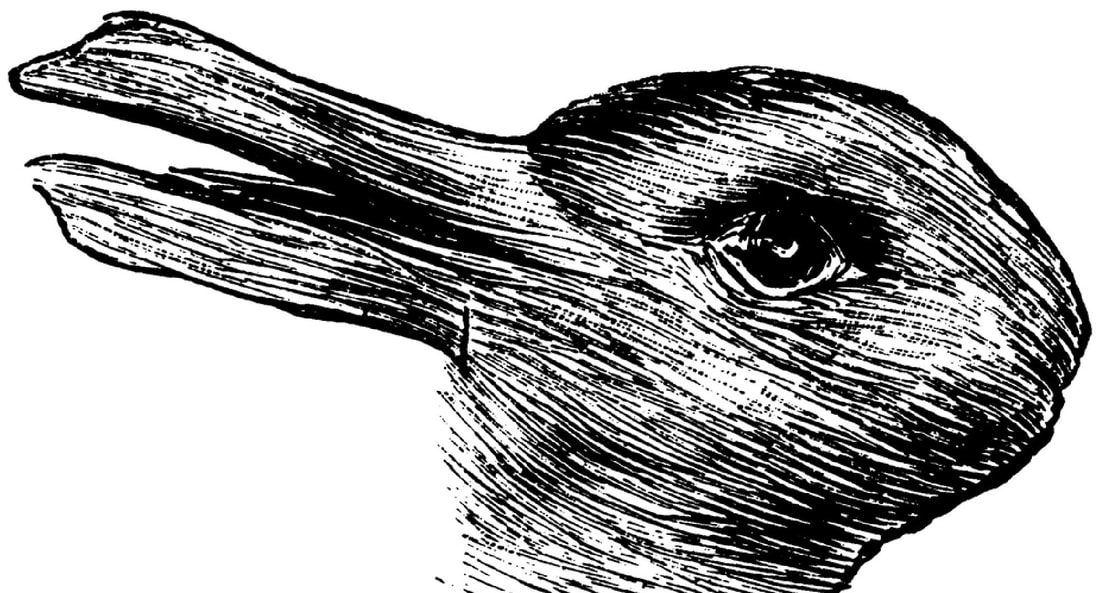

Take a look at the picture below. What animal do you see? Source: Rabbit–duck illusion Wikipedia Philosophers of science such as Kuhn (1962) and Feyerabend (1975) call the shift from duck to rabbit (and vice versa) as "gestalt switch." The drastic change of perspectives spells trouble for scientific progress. The crux is that competing research programs interpret the available facts in entirely different, incompatible ways based on their different yardsticks of scientific success (the incommensurability problem). The prior literature in asset pricing has largely perceived anomalies as indicating dysfunctional capital markets as a result of systematic investor mistakes and trading frictions (that prevent these mistakes from being eliminated). In contrast, my body of work has viewed anomalies as indicating well-functioning capital markets as a result of the net present value rule in capital budgeting on the part of managers. The change in perspective seems like a "gestalt switch." Back in the picture above, the animal cannot be a duck and a rabbit simultaneously. "Dubbit" doesn't exist. The real world is more ambiguous, though one can still ask the question which one of the two perspectives outlined above offers a more accurate description of capital markets in reality. Time will tell. The presentation below delves into the "gestalt switch" based on Liu, Whited, and Zhang (2009, Journal of Political Economy, "Investment-based Expected Stock Returns," see also article and slides): The latest word on GMMing investment returns is in Goncalves, Xue, and Zhang (2020, Review of Financial Studies, "Aggregation, Capital Heterogeneity, and the Investment CAPM," see article, slides, and the presentation below):

0 Comments

Zhang (2005), titled "The Value Premium," is back in the news in academic circles. As flattered as I am with the latest attention, most of which I didn't exactly ask for, it occurs to me that I should check the Web of Science cites. While I do follow Google Scholar, which is only one click away, the last time I checked Web of Science was in December 2009, when I was putting a dossier together to come to Ohio State. Back in the late 1990s and early 2000s, after the publication of Fama and French (1993, 1996), one of the more pressing tasks facing asset pricing theorists is to explain the value premium. Many of their works in this wave of theorizing were published around 2005. With 15+ years of time test, the table below shows the scorecard based on citations (that are at least objective): I have put a recording together for "The Value Premium," in which I reflect on the methodological choices (largely implicit in this article) as well as open challenges in this theoretical literature. See below please as well as slides: In the next-to-last section of the presentation above, I share my take on the recent disappointing performance of the value premium in the data: First, the high-minus-low decile on book-to-market earns on average only 0.3% per month (t = 1.58) from January 1967 to December 2020. However, the high-minus-low decile on operating cash flow-to-market earns 0.8% (t = 4.18) in the same sample period. I view the evidence as saying that (i) book equity fails to capture intangibles per Lev's influential body of work. And (ii) the value of intangibles can still be ascertained, effectively, from cash flows (Penman 2009). Second, as in book-to-market, operating cash flow-to-market has also suffered from poor recent performance (though to a lesser degree). Barring from the Covid shock, the past decade has been the longest boom in history. The causal mechanism based on costly reversibility and countercyclical price of risk in Zhang (2005) would predict that the value premium should come back going forward. (The expected value premium is countercyclical.) To invoke Karl Popper, this prediction is highly falsifiable. Time will tell. Finally, please see below for a video presentation on "The CAPM Strikes Back? An Equilibrium Model with Disasters" (Bai, Hou, Kung, Li, and Zhang 2019) as well as slides. Among other things, this article extends Zhang's (2005) industry equilibrium to general equilibrium with heterogeneous firms. I have just put a recording together for the published version of "Replicating Anomalies" (Hou, Xue, and Zhang 2020, Review of Financial Studies). See below please as well as slides: Please also see below Jack Forehand and Justin Carbonneau's "Excess Returns" Podcast Episode 73 on our article: Nir Kaissar at Bloomberg wrote a cool article on "Amazon and Other Tech Giants Buck the Empire Trap." Nir's article draws the difference between our investment factor and our expected growth factor. Our factor series are available at our global-q data library. Because our expected growth factor is relatively new, I thought I could elaborate its intuition against the background of our investment factor. The investment CAPM (a reformulation of the Net Present Value rule in corporate finance) says that the discount rate equals the marginal benefit of investment divided by the marginal cost of investment. And the marginal benefit includes expected profitability and expected growth. The investment factor is built on tangible investment, which is measured as the growth rates of book assets on the balance sheet. Tangible investment has little impact on expected growth. And the investment CAPM implies a negative relation between tangible investment and the cost of capital (captured by our investment factor). However, the expected growth factor is (mostly) built on operating cash flow, which accounts for some of the most reliably measured intangible investment at the firm level, such as R&D. Intangible investment raises expected growth. And the investment CAPM implies a positive relation between intangible investment and the cost of capital (captured by our expected growth factor). These economic insights are explained in depth in the latest draft of our security analysis paper. The expected growth factor is from our 2021 RoF article. Please see Slides and the video presentation: |

Lu Zhang

An aspiring process metaphysician Archives

September 2025

Categories |

RSS Feed

RSS Feed