|

Kewei, Chen, and I have finally launched our q-factors data library at:

global-q.org The old google site at "https://sites.google.com/site/theqfactormodel/" listed on the title page of Hou, Xue, and Zhang (2015, Review of Financial Studies) has been deleted. As a first step, the new data library site contains our q-factors series as well as testing portfolios formed on 50 anomaly variables, a subset from Hou, Xue, and Zhang ("Replicating anomalies," forthcoming, Review of Financial Studies). We will post more data online as our empirical work progresses. Thank you for your patience! Please feel free to drop us an email if you have comments on the data library and/or our work.

0 Comments

A cool friend of mine on Twitter, Drew Dickson at Albert Bridge Capital, joined in the latest exchange between behavioral finance and EMH with a nice post titled “Behavioral Finance Is Finance.” Drew is kind enough to cite my first blog post titled “Fama Is Right” in his article. Thank you Drew. I very much appreciate your kindness, seriousness, and thoughtfulness that permeate your writing. I find many of your points to be quite reasonable. And I take them very seriously. In this blog I argue that the newly developed investment literature has provided (or at least started to provide) answers to many of the important questions that Drew has raised. In no way I think my answers are complete or perfect. I am keenly aware of several remaining issues and I am actively working to resolve them. Most important, I value the opportunities to learn about others’ perspectives, especially those from asset managers with whom I don’t interact daily. I am fully capable of admitting mistakes when proven wrong. I am not very good at listening but I am trying. In what follows, I first quote directly from Drew's article and then provide point-by-point responses. “Does behavioral finance need to figure out a model of market equilibrium that makes markets efficient? Isn’t that a bit of a diversion? Hasn’t behavioral finance actually provided a theoretical underpinning for many of the most successful ‘factors’? Hasn’t behavioral finance made relevant these theory-less multi-factor models of market equilibrium?” Please let me clarify my perspective. Start with the accounting identity: Realized returns = expected returns + abnormal returns. When an anomaly variable forecasts realized returns, there are automatically two parallel interpretations. One, which is the behavioral view, says that the variable is forecasting abnormal returns. As such, pricing errors are forecastable, yielding a violation of EMH. The other, which is the EMH view, says that the anomaly variable is related to expected returns but the errors are unpredictable. The consumption CAPM and the investment CAPM are both about expected returns. Both are consistent with EMH. When I say no behavioral theory since 1985, I meant no theory of “abnormal returns.” If behavioral finance is to become a competing paradigm with EMH, the burden seems to be on its proponents to develop a theory of abnormal returns. Such a model doesn’t make markets efficient. It would be a theory of inefficient markets, a theory of pricing errors. And it’s not a diversion. It's the essence of behavioral finance. Why do investors make the same mistakes repeatedly year after year? When I say “equilibrium,” I don’t mean fancy math. I just meant prices being jointly determined by supply and demand. Like gravity, there is no escape from this law. How much you pay for your new house depends on whether the seller has a competing offer and whether you have in mind a backup house that you and your family like. There are indeed behavioral theories that link value and momentum to different psychological biases. However, these models all assume a constant discount rate (expected return). While a useful first stab, these models basically assume that all the return predictability in the data arises from predictable pricing errors. This is why many economists feel that the existing behavioral models just relabel things. More on this point later. “And it’s provided plenty of evidence that markets don’t always get things right. And frankly, there is very little supporting evidence of the risk story behind many of Fama and French’s proposed factors. Size? Maybe (big maybe). But why is value riskier than growth? Why are firms with better gross profitability riskier than those that are less profitable? Why are firms that efficiently invest capex more risky?” “And perhaps a more important, and bigger, question: why didn’t Fama and French include momentum in either their three or five factor models? They know it’s there. They know it’s a thing.” “The answer, because there is almost no possible risk explanation for momentum. The behavioral guys have plenty of reasons. They have common sense, intuitive reasons; motives like loss aversion, confirmation bias, anchoring and herding. Even Fama himself has admitted that momentum ‘is an embarrassment to the theory.’ Momentum isn’t embarrassing for Narasimhan Jegadeesh, Sheridan Titman, Cliff Asness, or Mark Carhart. Momentum isn’t embarrassing for those who know that behavioral finance hasn’t been a failure. For those guys, momentum is beautiful.” Very cool questions. Thank you. I respect and appreciate your frank communication. It is only through frank communication will I learn where my arguments fall short. I’ve been thinking about the same questions for 20 years ever since I started to do research in 1999 as a second-year Ph.D. student at Wharton. In what follows, I summarize my current, still evolving thoughts. I think I have reasonable answers. Again, in no way I think my answers are perfect. Please feel free to let me know where I screw up. So I can try to improve going forward. Momentum is a success story for the investment CAPM. As shown in the table below, UMD can be explained by the q-factor model in Hou, Xue, and Zhang (2015). The average return of UMD is 0.64% per month in the 1967-2018 sample, but its q-factor alpha is only 0.14%, with an insignificant t-value of 0.61. The return on equity (Roe) factor plays a major role in explaining UMD. The evidence shows that momentum is a noisy version of our Roe factor. Intuitively, the Net Present Value rule in capital budgeting says that high expected Roe relative to low current investment should imply high costs of capital (expected returns). And current Roe is a proxy for the expected Roe. That’s it.

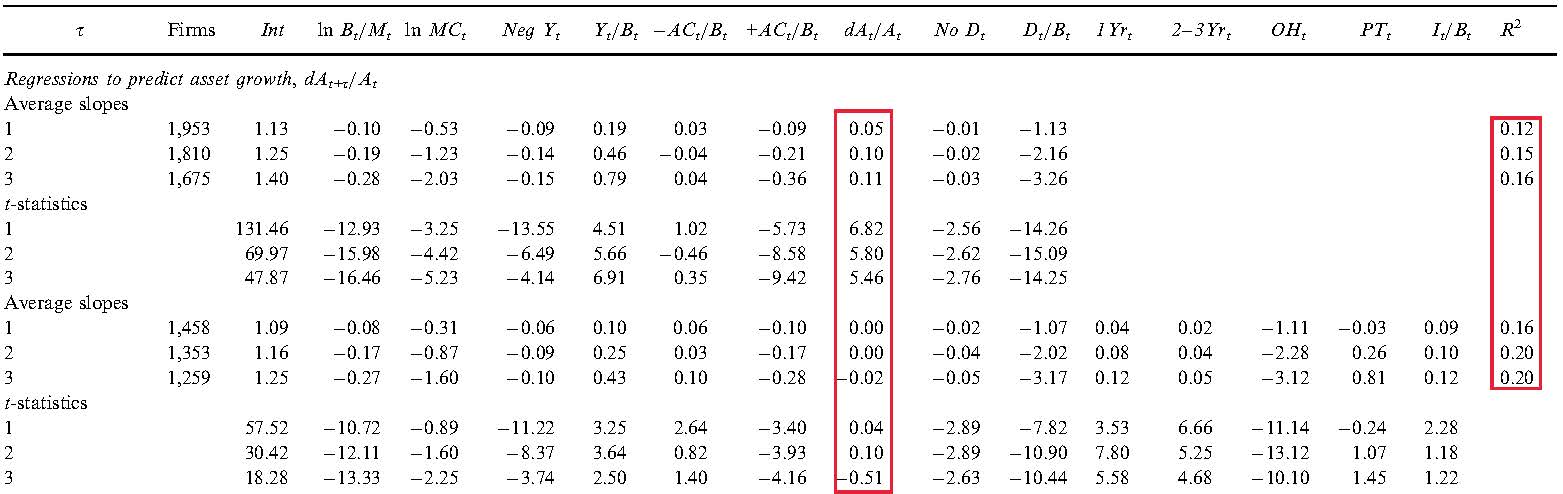

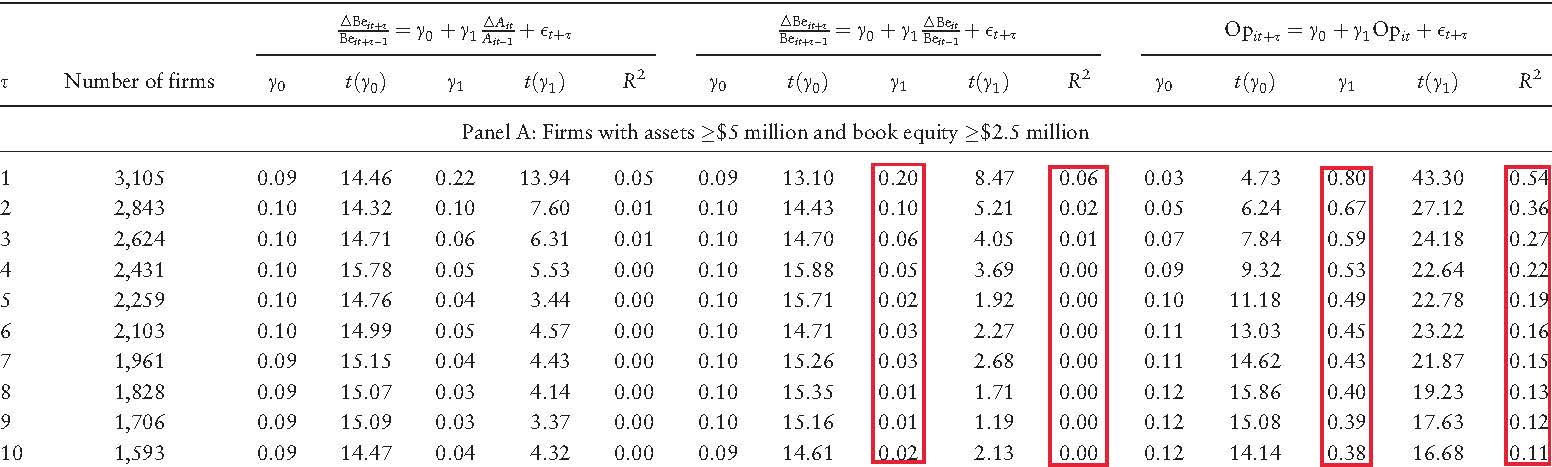

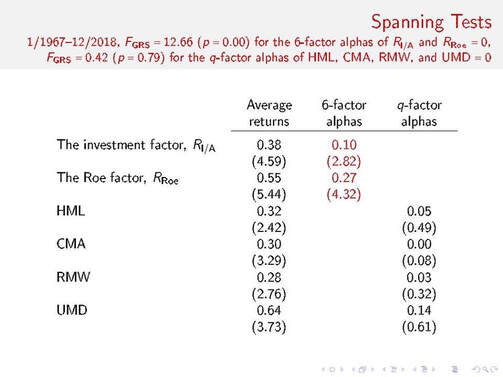

The difficulty arises as for what risks lurk behind momentum. I could follow Fama and French (1993) and call the q-factor loadings risk measures. And it will be correct from a statistical standpoint such as APT. But from an economic standpoint, I feel that a more precise interpretation of the q-factor model should be a linear factor approximation of the nonlinear characteristic model of the investment CAPM (Lin and Zhang 2013; Zhang 2017). However, I acknowledge that the investor-side CAPM and the supplier-side CAPM should be internally consistent. While the supplier-side CAPM is worked out in theory and in the data, it would be better if it can be demonstrated what exactly the risks are lurking behind the investor-side CAPM, at least conceptually. There are a few rational models floating around at this point, such as Johnson’s (2002) expected growth and Sagi and Seasholes’s (2004) growth options. And I have done a few econometric studies that link momentum to expected investment growth (Liu and Zhang 2014; Goncalves, Xue, and Zhang 2019). Intuitively, momentum winners have higher expected growth than momentum losers. And the expected growth is risky (to the extent that it might not be materialized). However, an important weakness of the current theoretical literature is that it lacks a unified equilibrium theory of value and momentum together. Li (2018) is the only example I can think of. We should work more to figure out the exact sources of risks behind expected growth (and momentum and Roe factors). In short, momentum is not a problem per se from the supply-side investment CAPM. Alas, a significant gap in our knowledge exists in terms of exactly how momentum can be consistent with the consumption CAPM in a fully specified model. As challenging as it is, I don't view it as insurmountable, however. Finally, as an economist, I have some preferences over an optimization-based model. Gene said in his latest interview that behavioral economists reply on investors being “stupid, repeatedly stupid.” Gene is right, in my view. Regardless of how sensible, intuitive the underreaction explanation might appear at a first glance, it’s hard to believe, for me at least, that investors would be confused for more than 50 years about post-earnings-announcement drift since Ball and Brown (1968). Once the horizon is that long, the biases explanation no longer feels sensible or intuitive. The fact that the drift persists for so long indicates to me that it is in fact part of the expected returns. “Behavioral economics is no longer the domain of rogue traitors attacking efficient market theory. Behavioral economists are the patriots of finance.” Bravo. I totally agree. I feel sorry that you even felt the need to make this statement. There is no question whatsoever in my mind that behavioral economists are patriots of finance. Thaler, Bernard, Thomas, Jegadeesh, Titman, Lakonishok, Sloan, and Ritter are heroes in my book. Reconciling their enormous contributions with what I learned in school has been my life’s endeavor. I’m very much indebted to them. I am very familiar with the role of a “traitor.” I am just doing my “betraying” in a different way. Alas, challenging the status quo is the essence of research. I feel that I have something new and important to say. And that’s the source of all my “treachery.” Behavioral finance is no longer a fringe field. It’s mainstream. Just like EMH before the rise of behavioral finance, a mainstream school of thoughts provides a ready target for the next generation of “traitors.” So get ready for more. I agree with behavioral finance on the facts (barring Hou, Xue, and Zhang 2019, "Replicating anomalies") but disagree on their interpretation. I know this is exactly what Gene said. But unlike Gene, I have theory, in addition to evidence, to back me up. I challenge my professional colleagues to prove me wrong, scientifically. References Ball, Ray, and Philip Brown, 1968, An empirical evaluation of accounting income numbers, Journal of Accounting Research 6, 159-178. Fama, Eugene F., and Kenneth R. French, 1993, Common risk factors in the returns on stocks and bonds, Journal of Financial Economics 33, 3–56. Goncalves, Andrei S., Chen Xue, and Lu Zhang, 2019, Aggregation, capital heterogeneity, and the investment CAPM, forthcoming, Review of Financial Studies. Hou, Kewei, Chen Xue, and Lu Zhang, 2015, Digesting anomalies: An investment approach, Review of Financial Studies 28, 650-705. Hou, Kewei, Chen Xue, and Lu Zhang, 2019, Replicating anomalies, forthcoming, Review of Financial Studies. Johnson, Timothy C., 2002, Rational momentum effects, Journal of Finance 57, 585-608. Li, Jun, 2018, Explaining momentum and value simultaneously, Management Science 64, 4239-4260. Lin, Xiaoji, and Lu Zhang, 2013, The investment manifesto, Journal of Monetary Economics 60, 351-366. Liu, Laura X. L., and Lu Zhang, 2014, A neoclassical interpretation of momentum, Journal of Monetary Economics 67, 109-128. Sagi, Jacob S., and Mark S. Seasholes, 2007, Firm-specific attributes and the cross-section of momentum, Journal of Financial Economics 84, 389-434. Zhang, Lu, 2017, The investment CAPM, European Financial Management 23, 545-603. (An earlier, shorter version of this article appeared earlier today on alphaarchitect.com under the title “Investment, Expected Investment, and Expected Stock Returns”. I thank Wes Gray for soliciting the article.) A new DFA article by Rizova and Saito (2019) titled “Investment and Expected Stock Returns” rehashes old (in my view, largely discredited) arguments by Fama and French (2006, 2015) on the investment factor: i) Valuation theory predicts that expected investment is negatively correlated with expected return, all else equal; and ii) Current asset growth is a good proxy for expected investment. According to Fama and French, the negative relation between expected investment and expected return then gives rise to the investment factor, which captures the negative relation between current investment and expected return in the data. Based on Hou et al. (2019a), this blog shows that Fama and French’s arguments are fundamentally flawed. I also summarize the conceptual foundation of Hou, Xue, and Zhang's (2015) investment factor, a foundation which in my view better captures the underlying economics of the investment factor. A Positive Relation between Expected Investment and Expected Return in Valuation Theory In Fama and French’s formulation of valuation theory, the discount rate is the internal rate of return, which is constant over time. While a useful concept, the constant discount rate return clearly contradicts the well accepted notion of time-varying expected returns. For instance, it is nowadays well accepted that expected returns are most likely higher in recessions than in booms. Expected momentum profits are reliably positive but only within one year post-formation and are negative afterward. Hou et al. (2019a) reformulate valuation theory with one-period-ahead expected return. They show that the relation between expected investment and the one-period-ahead expected return is more likely to be positive in the reformulated valuation theory. See their paper for the detailed derivations. Empirically, Fama and French (2006) in fact report a positive, albeit weak, relation between expected investment and expected return. They write: “Contrary to the predictions of the valuation equation (3), however, the return regressions of Table 3 produce positive average slopes on the Table 2 regression proxies for expected asset growth, but they are not reliably different from zero (p. 507).” Specifically, in their Table 3, which is reproduced below, the highlighted column below is the slopes on expected investment in monthly cross-sectional return regressions. The slopes are mostly positive, albeit insignificant. The evidence says that expected investment estimated via their specifications is positively related to the expected return, although the relation is weak. Table 3 in Fama and French (2006): Monthly cross-sectional return regressions Current Asset Growth Is a Poor Proxy for Expected Investment Continuing on the (in my view, wrong) path of a negative relation between expected investment and expected return, Fama and French (2015) ditch the two specifications of expected investment in Table 2 of their 2006 article and switch to current asset growth as the proxy for expected investment. Doing so yields a desired negative relation between expected investment and expected return. However, current asset growth is all but a poor proxy for expected investment. The evidence is borne out in Table 2 in Fama and French (2006) reproduced below. The table shows annual cross-sectional regressions of future asset growth on lagged firm variables, one of which is current asset growth. If asset growth is a perfect proxy for expected asset growth, the slopes on current asset growth should be close to one and drive out all other variables. However, the first highlighted column below does not support this view. In the shorter specification, the slopes on asset growth are economically small, albeit significant, indicating only weakly positive autocorrelations of asset growth. In the longer specification, the slopes on asset growth are all virtually zero and insignificant. Table 2 in Fama and French (2006): Multiple regressions to predict asset growth Further evidence is provided in Table VII in Hou et al. (2019a) reproduced below. The table shows annual cross-sectional regressions of book equity growth on current asset growth and, separately, on current book equity growth. The first highlighted column shows that the slopes on current investment when predicting future investment are far from one, 0.2 in the first year, and quickly falls toward zero afterward. The R-square starts at 6% in year one and falls largely to zero afterward. Table VII in Hou et al. (2019a): Annual cross-sectional regressions of future book equity growth and future operating profitability The last five columns in the table above show the cross-sectional regressions of operating profitability on current operating profitability. Operating profitability is substantially more persistent than investment, the slope in the first year is 0.8, and the R-square 0.54. This evidence supports Fama and French’s (2015) use of operating profitability as expected operating profitability in their 5- and 6-factor models as well as Hou, Xue, and Zhang’s (2015) use of current return on equity (Roe) as expected Roe in the q-factor model. In particular, earnings are often characterized as a random walk in the accounting literature. In sum, the evidence is clear that current asset growth is a poor proxy for expected asset growth, but current operating profitability is a good proxy for expected operating profitability. The evidence refutes Fama and French’s (2015) arguments of the investment factor via the expected investment channel. Investment, Expected Investment, and Expected Stock Returns: The Investment CAPM Perspective In the investment CAPM (Zhang 2017), investment and expected investment are related to expected return in two opposite ways. Hou, Xue, and Zhang (2015) propose the investment factor as a key driving force of expected stock returns. In Corporate Finance, the net present value (NPV) of a project is its present value (discounted value of the project’s future cash flows) minus its investment costs today. The NPV rule says that a manager should invest in a given project, if and only if the present value of the project is greater than or equal to its investment costs. When initially facing many projects with nonnegative NPVs, the manager should start with the project with the highest NPV and work her way down the supply curve of projects. A good project has a low discount rate, high profitability, and low investment costs. As the manager takes more and more projects, their investment costs become higher and higher, and their profitability lower and lower. For the last project that the manager takes, its NPV should equal zero: (A) Investment costs = Present value = Profitability/Discount rate. The investment CAPM turns the NPV rule, which is a fundamental principle in Corporate Finance, on its head and transforms it into an Asset Pricing theory. Rewriting the NPV rule yields: (B) Discount rate = Profitability/Investment costs. Relative to profitability, high investment firms incur higher investment costs, meaning that their discount rates and expected returns must be low. Relative to investment, high profitability firms must have high discount rates and high expected returns. In all, investment and profitability are two key driving forces of expected stock returns. The investment factor arises naturally from equation (B). Intuitively, given profitability, high costs of capital (discount rates) imply low NPVs of new projects and low investments, and low costs of capital imply high NPVs of new projects and high investments. Equations (A) and (B) apply to a static model with only one period. In a multiperiod, dynamic model, equation (A) becomes: (A’) Investment costs = Present value = (Profitability + Present value of cash flows from next period onward)/Discount rate. However, with optimal investment, the present value of cash flows from next period onward equals expected investment costs next period (marginal q equals marginal costs of investment). Accordingly, equation (B) becomes: (B’) Discount rate = (Profitability + Expected investment costs)/Investment costs. Intuitively, if investment and expected investment costs are high next period, the present value of cash flows from next period onward must be high. Because the benefits to investment this period are primarily the present value from next period onward, the benefits to investment this period must also be high. As such, if expected investment costs are high next period relative to investment costs this period, or equivalently, if expected investment is high next period relative to current investment, the discount rate must be high. The discount rate must be high to offset the high benefits of investment this period to keep current investment low. This intuition behind the positive relation between expected investment (growth) and expected return is analogous to the intuition behind the positive relation between profitability and expected return, i.e., the Roe factor in the q-factor model. And this is the core intuition underlying the expected investment growth factor in the q^5 model of Hou et al. (2019b). Factor Spanning Tests: The q-factor model versus the Fama-French (2018) 6-factor model The following table updates Hou et al.'s (2019a) factor spanning tests. The tests show that the q-factor model cleanly subsumes the Fama-French 6-factor model in head-to-head contests. Specifically, in the 1967-2018 monthly sample, the investment and return on equity (Roe) factors in the q-factor model earn on average 0.38% and 0.55% per month (t = 4.59 and 5.44), respectively. Their alphas in the Fama-French 6-factor regressions are 0.1% and 0.27%, both of which are significant (t = 2.82 and 4.32), respectively. The Gibbons, Ross, and Shanken (GRS, 1989) test strongly rejects the null hypothesis that the Fama-French 6-factor model can subsume the investment and Roe factors. In all, despite having two more factors, the Fama-French 6-factor model cannot subsume the q-factor model in the data.

Conversely, HML, CMA, RMW, and UMD in the Fama-French 6-factor model earn on average 0.32%, 0.3%, 0.28%, and 0.64% per month (t = 2.42, 3.29, 2.76, and 3.73), respectively. More important, their alphas in the q-factor regressions are economically small (tiny in many cases) and statistically insignificant: 0.05%, 0.00%, 0.03%, and 0.14% (t = 0.49, 0.08, 0.32, and 0.61), respectively. The GRS test cannot reject the null hypothesis that the q-factor model can subsume the HML, CMA, RMW, and UMD factors. In all, despite having two fewer factors, the q-factor model fully subsumes the Fama-French 6-factor model, including UMD. Summary Fama and French’s (2006, 2015) arguments for the investment factor are fundamentally flawed. Valuation theory, once reformulated in terms of the one-period-ahead expected return, implies a positive relation between expected investment and expected return, a prediction which Fama and French’s (2006) evidence also indicates. In addition, unlike profitability, firm-level asset growth is not (that) persistent, meaning that current asset growth is a poor proxy for expected investment. Most tellingly, Fama and French (2018) seem to have abandoned any theoretical discipline when adding the momentum factor, UMD, into their 6-factor specification: "We include momentum factors (somewhat reluctantly) now to satisfy insistent popular demand. We worry, however, that opening the game to factors that seem empirically robust but lack theoretical motivation has a destructive downside: the end of discipline that produces parsimonious models and the beginning of a dark age of data dredging that produces a long list of factors with little hope of sifting through them in a statistically reliable way (p. 237, my emphasis)." In contrast, the investment factor arises naturally from the investment CAPM, which in essence is a restatement of the Net Present Value rule in Corporate Finance. Intuitively, given profitability, high costs of capital (discount rates) imply low NPVs of new projects and low investments, and low costs of capital imply high NPVs of new projects and high investments. In all, it is perhaps time to embrace the supply approach to asset pricing to distill some theoretical discipline that the field of empirical asset pricing has been sorely lacking since, well, Fama and French (1993). After all, empirically, factor spanning tests show that the q-factor model fully subsumes the Fama-French 6-factor model in head-to-head contests. References Fama, Eugene F., and Kenneth R. French, 1993, Common risk factors in the returns on stocks and bonds, Journal of Financial Economics 33, 3–56. Fama, Eugene F., and Kenneth R. French, 2006, Profitability, investment and average returns, Journal of Financial Economics 82, 491-518. Fama, Eugene F., and Kenneth R. French, 2015, A five-factor asset pricing model, Journal of Financial Economics 116, 1-22. Fama, Eugene F., and Kenneth R. French, 2018, Choosing factors, Journal of Financial Economics 128, 234-252. Gibbons, Michael R., Stephen A. Ross, and Jay Shanken, 1989, A test of the efficiency of a given portfolio, Econometrica 57, 1121–1152. Hou, Kewei, Haitao Mo, Chen Xue, and Lu Zhang, 2019a, Which factors? Review of Finance 23, 1-35. Hou, Kewei, Haitao Mo, Chen Xue, and Lu Zhang, 2019b, q^5, working paper, The Ohio State University. Hou, Kewei, Chen Xue, and Lu Zhang, 2015, Digesting anomalies: An investment approach, Review of Financial Studies 28, 650-705. Rizova, Savina, and Namiko Saito, 2019, Investment and expected stock returns, Dimensional Fund Advisors. Zhang, Lu, 2017, The investment CAPM, European Financial Management 23, 545-603. A Facebook friend of mine forwarded me a video clip of Gene Fama’s latest interview on Bloomberg with Barry Ritholtz. I watched the full interview just now. And it occurs to me that I might have a few relevant things to say about the important issues discussed in the interview. The high point (or low point, depending on whom you ask) of the interview is when Gene says: “There is no behavioral finance. It’s all just a criticism of efficient markets, with no evidence.” Gene went on to clarify that 20 years ago, he challenged behavioral finance to come up with a theory that people can take to the data and test (Fama 1998). Fast forward to 20 years later, we are still waiting. Gene’s statement has caused an uproar on the internet. In particular, Dick Thaler responded with the following tweet: To no one’s surprise, I find myself mostly in agreement with Gene. I would drop the bit “with no evidence” but I find Gene’s statement to be accurate. The case for behavioral finance is extremely weak. On the theoretical side, it has been almost 35 years since De Bondt and Thaler (1985), yet there is still not a single coherent behavioral theoretical framework in sight, not to say its structural estimation that takes the theory to the data. Ideally, one would like to identify exactly what psychological biases are in play, the specific mechanisms via which the biases impact on equilibrium prices, and formal econometric estimation and tests to quantify the mechanisms in the data. Sure, there have been sporadic theoretical efforts, but the resulting models are typically so ad hoc (and so disconnected among themselves) that they have mostly been tested in an informal, reduced form way. On the empirical side, EMH says that pricing errors are not forecastable. I view EMH as equivalent to the Muth-Lucas rational expectations, which says that forecasting errors are not forecastable (a hat tip to my Wharton advisors' long-lasting influence on my work). Now, for the rubber to hit the road, one has to bundle EMH with an expected return model to isolate “pricing errors” or abnormal returns. The empirical literature has traditionally adopted the classic CAPM for this purpose and found its empirical performance to be lacking. The consumption CAPM performs even more poorly and remains mostly in theoretical papers on narrower topics. The Fama-French 3-factor model took over in 1993 as the workhorse empirical model, but the interpretation of SMB and HML is unclear. In all, the contribution of behavioral finance, which I acknowledge to be enormous, is to demonstrate the empirical failures of the (consumption) CAPM. However, the evidence does not reject EMH, at least not directly (the ubiquitous joint-hypothesis problem). During the past 20 years, instead of behavioral finance, it is investment-based asset pricing that has risen up to meet Fama’s (1998) challenge. And this newer literature has done so within the scope of EMH. The key insight of the investment literature is to price risky assets from the perspective of their suppliers (firms), as opposed to their buyers (investors) (Zhang 2017). Buyers are heterogeneous in preferences, beliefs, and information sets, all of which make the buy-side pricing exceedingly difficult. This statement just reflects the classic, largely intractable aggregation problem in equilibrium theory (the Sonnenschein-Mantel-Debrew theorem). Who’s the marginal investor of Apple Inc.? Your guess is as good as mine. On the supply side, who’s the marginal supplier of Apple Inc.? Well, easy, that’s Apple Inc. No aggregation difficulty even remotely in the same magnitude as that plaguing the (consumption) CAPM (or any other demand-based theories). As a new class of Capital Asset Pricing Models, the investment CAPM arises from the first principle of real investment for individual firms. Building on the first principle, the investment CAPM is every bit as rigorous as any economic theory that I am aware of, including, in particular, the consumption CAPM. The academic literature has been evaluating the empirical, explanatory power of the investment CAPM in the past decade. The evidence so far seems rather encouraging. Hou, Xue, and Zhang (2015) motivate the investment and return on equity factors in the q-factor model from the investment CAPM. Close cousins of the q-factor model have subsequently appeared in different disguises in the Fama-French (2015, 2018) 5- and 6-factor model, the Stambaugh-Yuan (2017) “mispricing” factor model, and the Daniel-Hirshleifer-Sun (2019) behavioral 3-factor model. See Hou et al. (2019a) for a detailed exposition. In particular, the following table shows that the 4-factor q-model fully subsumes the Fama-French 6-factor model in head-to-head factor spanning tests. In terms of structural estimation, Liu, Whited, and Zhang (2009) perform the first such estimation of the investment CAPM in a way that is analogous to what Hansen and Singleton (1982) did for the consumption CAPM. Although by no means perfect, Liu et al.’s first stab yields much more encouraging results than Hansen and Singleton’s at the consumption CAPM. The baseline investment model with only physical capital manages to explain value and momentum separately, albeit not jointly. The joint estimation difficulty has been largely resolved in Goncalves, Xue, and Zhang (2019), who introduce working capital into the investment framework. With plausible parameter estimates, the two-capital investment model manages to explain the value, momentum, investment, and return on equity premiums simultaneously. The next step is to investigate out-of-sample performance and to develop an ex-ante, expected return model that can compete with the implied costs of capital from the accounting literature.

I view the investment CAPM and the consumption CAPM as complementary in theory. Marshall (1890, Principles of Economics) writes: “We might as reasonably dispute whether it is the upper or under blade of a pair of scissors that cuts a piece of paper, as whether value is governed by utility or costs of production. It is true that when one blade is held still, and the cutting is affected by moving the other, we may say with careless brevity that the cutting is done by the second; but the statement is not strictly accurate, and is to be excused only so long as it claims to be merely a popular and not a strictly scientific account of what happens (Marshall, 1890 [1961, 9th edition, p. 348]).” Clearly, by only looking at demand, the consumption CAPM is incomplete even in theory. The investment CAPM is the missing “blade.” The covariance, SDF-centric view of the world only describes the optimal demand behavior. The supply side is all about characteristics. So much for the covariances versus characteristics debate. In my big-picture, there is no obvious place for behavioral finance. The field has gained its prominence by documenting non-zero means of the CAPM residuals and sticking labels such as under- and over-reaction to them. However, the evidence has been piling up that the investment CAPM alphas are not that big to begin with. I should acknowledge that the investment CAPM is silent about investor rationality. And that’s the whole point. Investor rationality and EMH are two different things. Remember EMH only says that pricing errors are not forecastable. The investment CAPM alphas are mostly not forecastable. And the expectations in the investment CAPM are entirely rational. Investors might be optimistic and attempt to bid up the equity prices too high. But with a manager’s cool head, the supply of risky shares goes up. In the special case of no adjustment costs, in particular, Tobin’s q will forever be one, regardless of how irrationally optimistic investors are. This equilibrating role of the supply side seems to be greatly underappreciated in the existing literature. We are blind to this parallel universe thanks to the consumption CAPM's single-minded, dogmatic focus on demand. I can empathize that after more than 50 years of the classic CAPM, it’s intellectually hard to divorce EMH from the (consumption) CAPM. But the (consumption) CAPM is just the blunt “blade” due to its inescapable, intractable problem of aggregation. After marrying EMH with the sharp “blade” of the investment CAPM, we see that capital markets simply obey standard economic principles. The world makes sense! Investor behavior is a separate, important field, but is partial equilibrium in nature. Without tackling aggregation, investor behavior has close to nothing to say about equilibrium pricing. Again, investor rationality and EMH are not the same thing. I certainly do not agree with everything that Gene said in the interview. Wall Street research is definitely not “business-related pornography.” Financial analysts are an important component of financial intermediary that facilitates the information flow and smooth functioning of our capital markets. Graham and Dodd’s (1934) Security Analysis works in the data, as shown by a mountain of evidence in the accounting literature. And it is perfectly consistent with the investment CAPM, which predicts cross-sectionally varying expected returns, depending on investment, profitability, and expected growth (Hou et al. 2019b). In Thaler’s tweet, he claims that Gene owes him everything. I think Dick got the chronology exactly backward. Gene founded modern finance with EMH, against which Dick has successfully built his entire career. If anything, Dick owes Gene everything. I, on the other hand, owe much of my career to behavioral finance, whose tremendously important empirical contributions, with little in the way of theory, have left a glaring gulf for a theory-minded economist to fill. References Daniel, Kent D., David Hirshleifer, and Lin Sun, 2019, Short- and long-horizon behavioral factors, forthcoming, Review of Financial Studies. De Bondt, Werner F. M., and Richard Thaler, 1985, Does the stock market overreact? Journal of Finance 40, 793-805. Fama, Eugene F., 1998, Market efficiency, long-term returns, and behavioral finance, Journal of Financial Economics 49, 283-306. Fama, Eugene F., and Kenneth R. French, 2015, A five-factor asset pricing model, Journal of Financial Economics 116, 1–22. Fama, Eugene F., and Kenneth R. French, 2018, Choosing factors, Journal of Financial Economics 128, 234–252. Goncalves, Andrei S., Chen Xue, and Lu Zhang, 2019, Aggregation, capital heterogeneity, and the investment CAPM, forthcoming, Review of Financial Studies. Graham, Benjamin, and David L. Dodd, 1934, Security Analysis, 1st ed., New York: Whittlesey House, McGraw-Hill Book Company. Hansen, Lars P., and Kenneth J. Singleton, 1982, Generalized instrumental variables estimation of nonlinear rational expectations models, Econometrica 50, 1269–1288. Hou, Kewei, Haitao Mo, Chen Xue, and Lu Zhang, 2019a, Which factors? Review of Finance 23, 1–35. Hou, Kewei, Haitao Mo, Chen Xue, and Lu Zhang, 2019b, Security analysis: An investment approach, working paper, The Ohio State University. Hou, Kewei, Chen Xue, and Lu Zhang, 2015, Digesting anomalies: An investment approach, Review of Financial Studies 28, 650-705. Liu, Laura X. L., Toni M. Whited, and Lu Zhang, 2009, Investment-based expected stock returns, Journal of Political Economy 117, 1105-1139. Marshall, Alfred, 1890, Principles of Economics (9th ed.) (London: Macmillan, first published in 1890, 1961). Stambaugh, Robert F., and Yu Yuan, 2017, Mispricing factors, Review of Financial Studies 30, 1270–1315. Zhang, Lu, 2017, The investment CAPM, European Financial Management 23, 545-603. |

Lu Zhang

An aspiring process metaphysician Archives

September 2025

Categories |

RSS Feed

RSS Feed