|

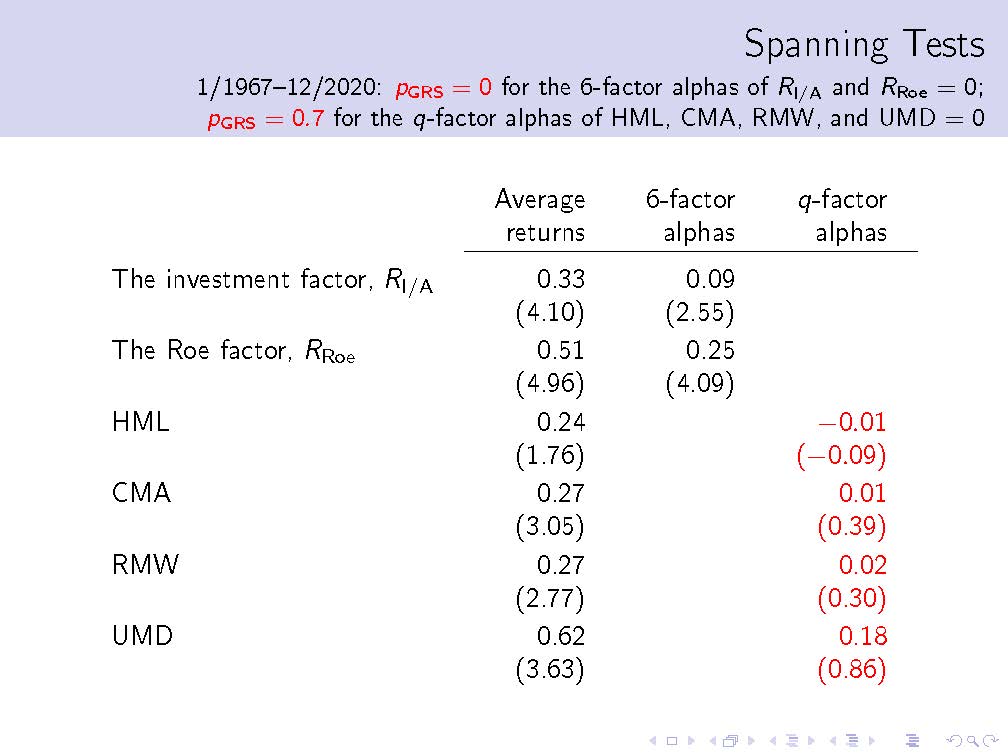

We have just released the latest q-factors data library that has been updated through December 2020. The table below shows that the Hou-Xue-Zhang (2015) q-factor model continues to fully subsume the Fama-French (2018) 6-factor model in the extended sample from January 1967 to December 2020. The Fama-French 6-factor model cannot explain the q-factors. The investment premium is 0.33% per month (t = 4.1), with a 6-factor alpha of 0.09% (t = 2.55). The return on equity (Roe) premium is 0.51% (t = 4.96), with a 6-factor alpha of 0.25% (t = 4.09). The Gibbons-Ross-Shanken (1989, GRS) test strongly rejects the 6-factor model with the null hypothesis that the 6-factor alphas of the investment and Roe premiums are jointly zero (p = 0.00). More important, the Hou-Xue-Zhang q-factor model fully subsumes the Fama-French factors. The HML, CMA, and RMW premiums are on average 0.24%, 0.27%, and 0.27% per month (t = 1.76, 3.05, and 2.77), but their q-factor alphas are virtually zero, -0.01%, 0.01%, and 0.02% (t = -0.09, 0.39, and 0.3), respectively. UMD is on average 0.62% (t = 3.63), but its q-factor alpha is only 0.18% (t = 0.86). The GRS test fails to reject the q-factor model with the null that the q-factor alphas of HML, CMA, RMW, and UMD are jointly zero (p = 0.7). So, is asset pricing scientific? Popper's (1959) demarcation between science and non-science hinges on falsifiability. Lakatos (1970) says that a scientific research program should be "progressive" in that it needs to explain empirical puzzles with few ad hoc fixes. Despite his early "mob psychology" regarding theory choice in Structure (1962), Kuhn (1977) later characterizes a good theory in terms of its accuracy, consistency, scope, simplicity, and fruitfulness. Finally, Feyerabend (1975) argues that science is an anarchic enterprise with no particular epistemic order. While conscientious about external forces at work, we are determined to show Feyerabend is wrong about asset pricing. References Feyerabend, Paul, 1975, Against Method, New Left Books. Kuhn, Thomas S., 1962, The Structure of Scientific Revolutions, University of Chicago Press. Kuhn, Thomas S., 1977, Objectivity, value judgment, and theory choice, in T. S. Kuhn, The Essential Tension, University of Chicago Press. Lakatos, Imre, 1970, Falsification and the methodology of scientific research programmes, in Criticism and the Growth of Knowledge, I. Lakatos and A. Musgrave (eds.), Cambridge University Press. Popper, Karl, 1959, The Logic of Scientific Discovery, Hutchinson & Co.

2 Comments

|

Lu Zhang

An aspiring economic philosopher Archives

February 2024

Categories |

RSS Feed

RSS Feed