|

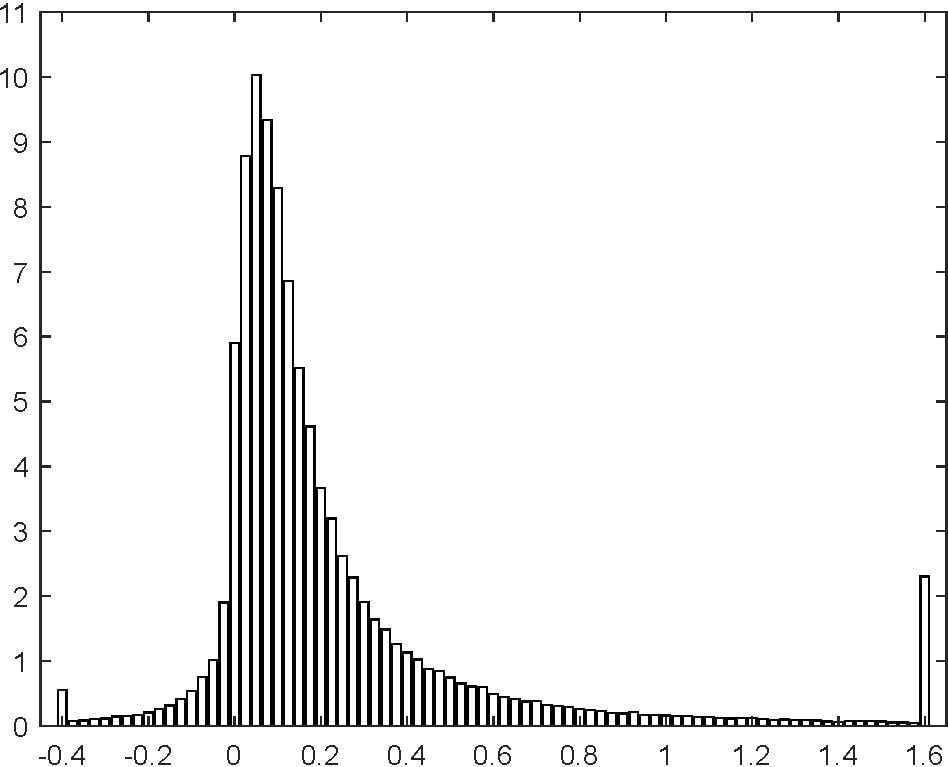

We have just completed a massive empirical paper "Asymmetric investment rates" (Bai, Li, Xue, and Zhang 2022), with 128 pages short. The main data work is to construct firm-specific current-cost capital stocks (the replacement costs) for the entire Compustat sample. The headline result is that the firm-level current-cost investment rate distribution is heavily right-skewed, with a small fraction of negative investment rates, 5.51%, but a huge fraction of positive investment rates, 91.64%. The histogram below (Figure 4 in our paper) shows that the firm-level asymmetry is comparable with, if not more impressive than, the Cooper-Haltiwanger (2006) plant-level evidence (their Figure 1). I've also put some slides together for my upcoming keynote at the 2022 Financial Markets and Corporate Governance Conference (FMCG) organized by Monash Business School.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Lu Zhang

An aspiring process metaphysician Archives

September 2025

Categories |

RSS Feed

RSS Feed