|

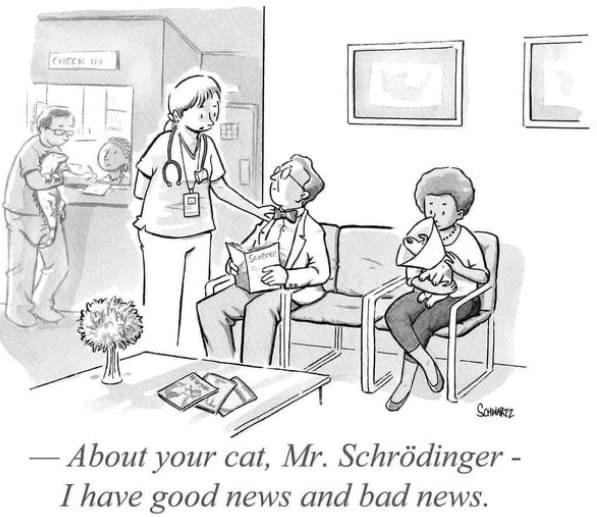

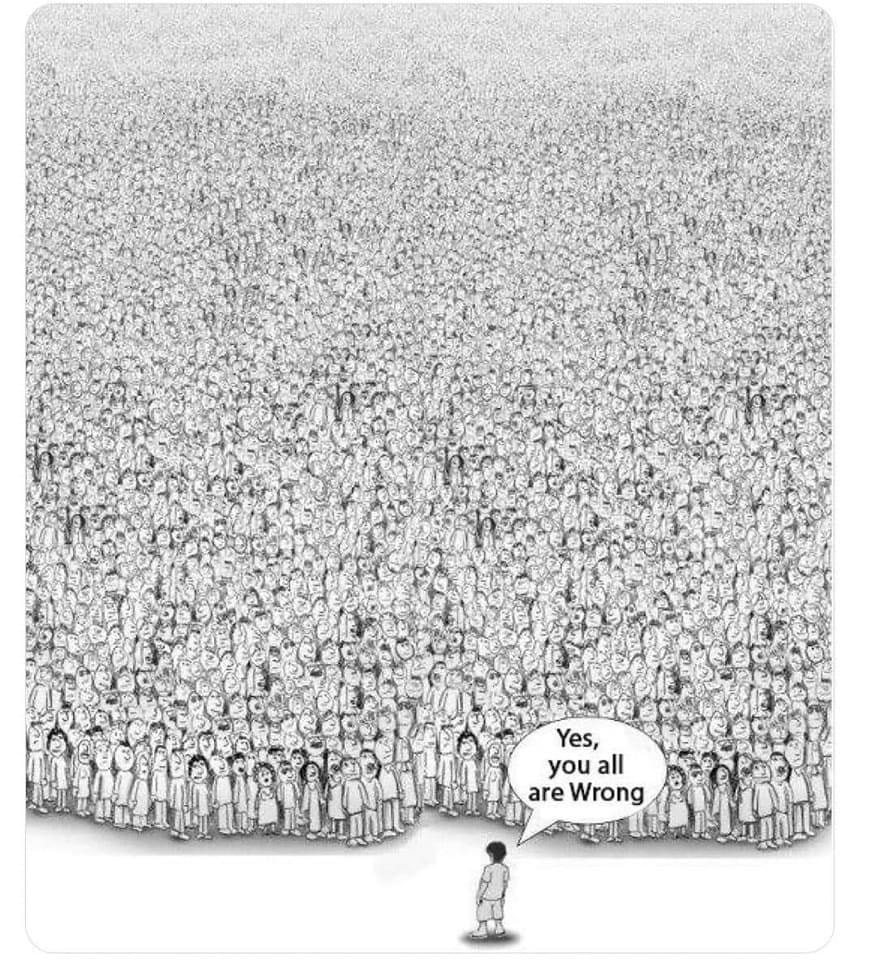

I might have finally awakened from my dogmatic slumber. I have started to question equilibrium theory, systematically. And I know exactly where to hit. A Wittgensteinian turn. A mid-life crisis (of sorts). My immediate task is the consumption vs. investment CAPM debate. I have come to realize that the debate is less about demand vs. supply of assets but more about macro vs. micro finance. Despite my effort (2019 JFE), I see no way to bridge the micro-macro gap within the Arrow-Debreu world. The world is not flat. The empirics-theory gap in asset pricing is in fact the micro-macro gap. Walras (1874) was following Newton's clockwork universe. However, modern physics features both general relativity (macroscopic) and quantum mechanics (microscopic), as well as many layers in between (e.g., solid-state physics). No one has ever claimed, macro-reductively, that physics is all about general relativity. (Like asset pricing is all about the SDF.) Einstein never dismissed quantum mechanics as not physics. He just wanted a better link with general relativity. (Spacetime might be emergent from the quantum wave function, but how? Source: Facebook) Analogously, asset pricing cannot possibly be nothing but the SDF. Alas, this SDF nothing-buttery is the organizing principle for all our asset pricing textbooks (MBA and PhD) and most of the scientific literature (especially asset pricing theory). The SDF nothing-buttery is what Daniel Dennett (1995, "Darwin's Dangerous Idea") would call "greedy reductionism." When "in their eagerness for a bargain, in their zeal to explain too much too fast, scientists and philosophers often underestimate the complexities, trying to skip whole layers or levels of theory in their rush to fasten everything securely and neatly to the foundation (p. 82)." Dennett was defending biology as a separate field from physics. No one has ever felt the need to defend physics (micro) from biology (macro). Philip Anderson (1972, "More Is Different") was defending solid-state physics from particle physics: "At each stage, entirely new laws, concepts and generalizations are necessary, requiring inspiration and creativity to just as great a degree as in the previous one." Anderson was defending macro (meso at least) from micro, not the other way around. Alas, defending micro against macro is the peculiar position where I find myself in asset pricing. Against the consumption orthodoxy in macro finance, I am reiterating, for the Nth time, in which N is large enough for statistical mechanics to work, that the investment CAPM is a separate, emergent asset pricing theory in micro finance. This time I have philosophy of science on my side. The investment CAPM clearly works in the data. The q-factor model has just appeared in Bodie, Kane, and Marcus's (2024) Investments (13e). It seems that the 6-factor model, with epicycles on top of epicycles, is running mostly on personal loyalty, which should have played no role relative to scientific merits. As a scientific realist, I infer from the anomalies evidence to its best explanation that the investment CAPM corresponds to how the (micro) world works, but the consumption CAPM does not. Again, think quantum vs. classical mechanics. It would be a miracle for the q-factor model to succeed in the anomalies literature if the investment CAPM does not describe our micro reality (Putnam's [1975] no-miracles argument). Corporations, not investors, are the primary causal powers of their own asset prices. God help me. (Me vs. SDFists. Source: Facebook) (Never could have imagined the 3-factor model was just a warmup.) The big question looms large: Is there a theory of everything (like in physics) that can unify micro and macro finance? I am working on it. Feel free to join me. It's not a one-person job. It will likely take decades, if not a century. Just look at theoretical physics. And if it exists, it's not equilibrium theory. The representative agent is not an agent. The marginal investor is not an investor. (Much like an ant colony is not an ant.) They are meaningful (like Santa Claus, unicorn, pegasus) in our story telling. But without microfoundation, they do not exist in our social ontology (Little 2016). No microfoundation, no explanation. So even if you find an SDF that fits the data in micro finance, I can still contest your explanatory power. Whatever the unified theory down the road, the investment CAPM will survive, because a corporation is an actor (agent). Once asset pricers learn to build macro models from bottom up, hopefully by 2123, with heterogeneity among diverse actors playing an essential role, the consumption CAPM will be remembered, nostalgically, like the 3-factor model. Please see below for a progress report (as of last October) at the 2022 FMA Annual Meetings (slides). The presentation title is inspired by W. V. O. Quine's (1951) "Two dogmas of empiricism." Note: At 55:15, I said "When you write down a FORTRAN program, you already assume the world is like Newtonian mechanics." I'd like to take it back. Lucas might well be right about computational social science, but the program is unlikely about equilibrium or in FORTRAN.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Lu Zhang

An aspiring process metaphysician Archives

September 2025

Categories |

RSS Feed

RSS Feed